Compounding Requires Time, Stability, Patience

August 29, 2025

The big money is not in the buying and the selling but in the waiting.

—Charlie Munger

Quiet markets can feel uneventful, but they’re often when the real work of investing takes place. Compounding isn’t flashy. It requires time, stability, and patience. When volatility is subdued and trends are intact, progress builds quietly in the background, setting the stage for meaningful long-term results.

That doesn’t mean we’re idle. A systematic investing process doesn’t switch off when markets are calm; it keeps monitoring, measuring, and preparing. Calm periods are when discipline is reinforced, so that when conditions inevitably change, the system can respond with clarity instead of emotion.

In this month’s note, we explore why periods of calm are powerful for investors — and why staying prepared, not passive, is the key to long-term success.

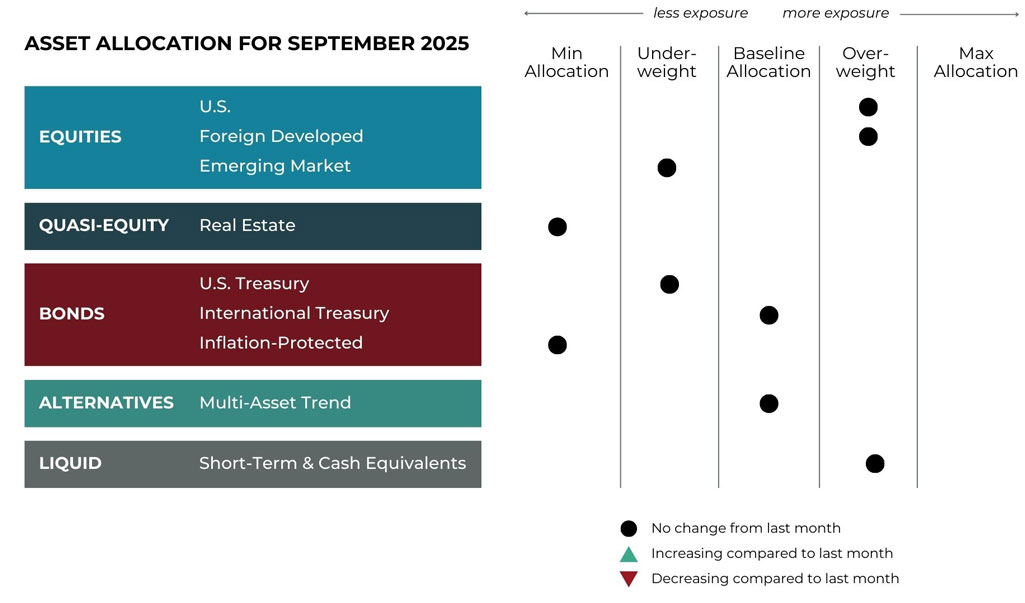

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for September.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

Exposure will not change and remain overweight. Both the intermediate- and long-term trends are positive.

International Equities

Overall exposure will not change and remain at baseline. Trends continue to be positive across all timeframes and tilted toward foreign developed equities given its relative strength.

Real Estate

Exposure will not change and remain at its minimum.

U.S. & International Treasuries

U.S. exposure will not change and remain underweight. Trends in the middle part of the U.S. Treasury yield curve are positive while the long-term end is negative. International Treasuries have weakened but are maintaining uptrends, and their overall allocation will remain at its baseline allocation.

Inflation-Protected Bonds

Exposure will be at its minimum. Trends are still positive but the group remains weak versus other fixed income assets.

Alternatives

Short-Term Fixed Income

Exposure will not change, having previously absorbed exposure from weaker, higher-duration bonds.

Asset-Level Overview

Equities & Real Estate

The S&P 500 fell 1.6% to start August, extending weakness from the final day of July. From there volatility declined with prices resuming their rising trend. In fact, by the mid-month, the benchmark index made new all-time highs, its 18th of 2025. As a result, trends across all timeframes remain positive and our portfolios will continue to be overweight.

The gap in 2025 performance between U.S. and international stocks — which has been slowly closing this summer as the U.S. has caught up — reopened in August, with both developed and developing markets outpacing U.S. Like U.S. equities, trends in international equities continue positive. Our portfolios will remain near their baseline allocations abroad, with a tilt toward developed markets.

Among the equity and quasi-equity allocations, real estate remains weakest. Price action is currently the epitome of rangebound, with year-to-date high and lows within about 5% of each other going back to the end of April. The outcome of such trendless conditions will be a continued allocation at the minimum in this asset class, with exposure previously being handed up to much stronger U.S. equities.

Fixed Income & Alternatives

At a high level, fixed income performance remains locked in the same pattern we’ve seen for several months. Short-term up to intermediate-term bonds continue to slowly churn mostly higher, while long-term bonds remain weak. This is generally the case whether one is looking at U.S. fixed income or abroad. The mixed results lead to a varied portfolio, with material exposure to the short-duration side of things and almost no exposure on the long end.

Within the multi-asset trend alternatives bucket, short-term fixed income futures and other related instruments remain the most significant in terms of allocation. Exposure to longer-duration bonds remains primarily in short positions. Commodities, such as gold and cocoa, also make up noteworthy positions. Meanwhile, the continued strength in stocks globally has caused net long exposure to increase there as well. The U.S. Dollar’s steady decline has caused this segment to increase allocations to foreign-denominated currencies.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 7/31/2025 to 8/1/2025; Vettafi.com, “S&P 500 Snapshot: The Jackson Hole Rally," 8/22/2025; and Barchart.com, Real Estate Vanguard ETF (VNQ), 4/1/2025 to 8/26/2025

3 Potential Catalysts For Trend Changes

Inflation Data: Inflation held steady in July despite President Donald Trump’s tariff increases, which left a mark on some consumer prices and kept a Federal Reserve rate cut in play. Consumer prices were up 2.7% in July versus a year earlier, which is unchanged from June’s gain. Prices excluding food and energy categories rose 3.1% during the past 12 months, slightly above forecasts for 3%. Prices either fell or stabilized in categories consumers tend to pay the most attention to, such as shelter, energy, and groceries. This helped keep overall inflation in check. Energy prices declined, grocery prices were roughly flat, and rent growth was modest in July. The absence of exaggerated acceleration in price pressures removes a hurdle to lowering rates for the Fed, especially as there are growing concerns about a slowing labor market.

Jobs, Jobs, Jobs: The Labor Department reported the size of the unemployed population hit a new recent high earlier in August. Continuing claims, which is an indicator of the size of the total unemployed population, came in at 1.97 million in early August. That is a new high since November 2021, evidence that slow hiring is frustrating job searchers. Additionally, a difficult jobs report from the Bureau of Labor Statistics included downward revisions showing the labor market was far less healthy this spring than previous reports indicated. Although hiring has stalled, recent initial-claims data suggest companies are not laying people off in volume, rather they are simply not bringing on new employees. One in five U.S. employers surveyed by the Conference Board said they plan to slow hiring in the second half of 2025; that is about double the rate of companies that anticipated bringing on fewer people at this time last year. It is currently taking the average worker 24 weeks to find a job after losing one, which is about a month longer than a year ago.

Housing Brightening: Sales of existing homes rose unexpectedly in July. The news increased hopes that the moribund housing market may be improving and that activity can gain more momentum this fall. Home sales were up 2% from the prior month to a seasonally adjusted annual rate of 4.01 million. The housing market is stuck in a third-straight year of depressed sales. However, some analysts say the fall season could see sales. Inventory of unsold homes – both new and existing – has also reached the highest level since November 2019, which is a positive sign for home buyers and a reason why the rate of annual price growth is slowing. More than 20% of listings had some kind of price cut in July, and average home sales prices are now falling in some parts of the U.S., especially in the Sunbelt. The median existing-home price in July was $422,400, a little lower than the record price in June, but still up 0.2% from a year earlier.

Sourcing for this section: The Wall Street Journal, “Inflation Held Steady at 2.7% in July,” 8/12/2025; The Wall Street Journal, “U.S. Jobless Claims Rose Last Week,” 8/21/2025; The Wall Street Journal, “More U.S. Companies Plan to Slow Hiring in Second Half of 2025,” 8/21/2025; and The Wall Street Journal, “Home Sales Surprisingly Rose in July While Prices Eased,” 8/21/2025

Calm Continues: When Stability Becomes the Strategy

The stock market is designed to transfer money from the active to the patient.

—Warren Buffett

Another month has passed with little to report in markets — and that’s not a complaint. Despite a steady stream of economic headlines, major indexes barely moved in August. Volatility remained subdued, and our portfolios require no significant changes as a result. It’s a good reminder: investing success isn’t always about reacting. Sometimes it’s about the patience and discipline to let the work you’ve already done keep compounding.

Why a Quiet Market Can Be So Powerful

While it’s natural to associate tactical investment strategies with rapid response to market events, the reality is that periods of low volatility are often when they perform best.

When conditions are calm, compounding has room to work. Gains are less likely to be disrupted by sudden downturns, which allows progress to build steadily. With fewer portfolio adjustments, frictional costs — primarily in the form of taxes — are reduced, preserving more of each dollar earned.

Additionally, trends can gain strength. Stronger segments of the market — which in 2025 have been areas like technology and growth-oriented sectors — have time to extend their leadership, which can enhance relative returns over more static approaches.

Prepared, Not Passive

Of course, stability today doesn’t guarantee calm tomorrow. Our process continuously monitors market conditions so that when the tone shifts, we’re ready to adapt. That readiness is key: markets don’t send calendar invites before they change direction, and protecting capital during drawdowns can have a dramatic effect on long-term outcomes. Avoiding a major decline doesn’t just save dollars in the moment — it shortens the time needed to recover and helps investors remain confident in their plan.

For now, however, the market environment is working in favor of long-term investors. The absence of major disruption means our existing positioning continues to serve clients well, and we are content to let this stability work on their behalf. At Warren Wealth Management, we believe successful investing is as much about restraint as it is about action. In quiet markets like this, restraint isn’t inaction — it’s strategy.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead